Subsequently, lenders are requesting evidence of cash flow from superior and bad credit borrowers to aid them make better financial loans.

That can help make certain that you receive funded and to be sure you get a superb deal in your freelancer bank loan, go through our stage-by-stage manual to getting a small business loan.

Should you be a freelancer looking for the most effective business enterprise line of credit, you’ll notice that Fundbox is among the easiest on-line lenders to operate with. Fundbox provides revolving strains of credit score nearly $one hundred fifty,000.

Registering oneself as a business entity is an efficient area to start out. This may be completed speedily providing you know the kind of business enterprise entity you want to to generally be.

When self-employed, you may have set up business enterprise credit, or you may be focusing on separating your personal credit score with the entire process of transitioning to your “confined liability Company” or “LLC”.

Even so, before you go to the lender to use, there are several issues you have got to ascertain. 1st, you should establish the quantity you qualify for. This may be established working with normal month-to-month payrolls.

Remaining value is determined at enough time of print or electronic submitting and could change based upon your real tax predicament, varieties applied to arrange your return, and varieties or schedules A part of your personal return. Prices are topic to alter all at once and will affect your final cost. If you choose to depart Entire Services and operate with the impartial Intuit TurboTax Confirmed Pro, your Pro will provide information regarding their person pricing in addition to a different estimate after you explore your tax circumstance with them.

Alternate lenders ensure it is less difficult than conventional lenders for that self-employed to have the capital they will need. Discover if any of those freelance financial loans will give you the results you want.

With a bit of investigate and time, you may be able to determine these components by yourself. When you are having difficulties or coping with an strange circumstance, you should check out your local back again for steerage.

Incorporating a co-signer to your software can entice lenders to supply a lower desire rate and better loan quantity. In case you will be able to repay the financial loan punctually you'll be able to Strengthen your as well as your cosigner's credit rating.

A credit history builder mortgage can be a economical item which will help consumers establish a optimistic credit rating heritage. Unlike a traditional loan, borrowers will receive a…

Title loans are just one type of secured mortgage that employs a borrower’s car or truck as collateral. The financial loan quantity is going to be dependant on the value of your vehicle, money, and skill to repay the bank loan.

The offers that look on this site are from third party advertisers from which Acorn Finance receives compensation. This payment might affect how and where merchandise surface on This website (like, for example, the purchase during which they seem). Acorn Finance strives to existing a big range of features, however the gives demonstrated will not signify all economic companies organizations or items that could possibly click here be available to you.

The Dave app contains a $one every month fee that you must pay irrespective of whether you are taking a cash advance, and you've got the option to depart a suggestion if you are taking a cash advance that will help continue to keep the cash flowing.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Karyn Parsons Then & Now!

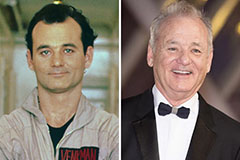

Karyn Parsons Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!